How to Organize Bank Statements: Step-by-Step Guide for Efficient Financial Management

Organizing is key to efficiently managing financial documents. Knowing how to organize bank statements is the most basic in accounting and bookkeeping. However, you might be in the field for a long period or still new within the practice, there are some new ways you might learn to organize bank statements across different types, periods, and clients. In this blog, we’ll discuss the benefits of organizing your bank statements, a step-by-step guide, and how OCR can help you organize it in a snap. Track every expense you have – Download our spreadsheet here

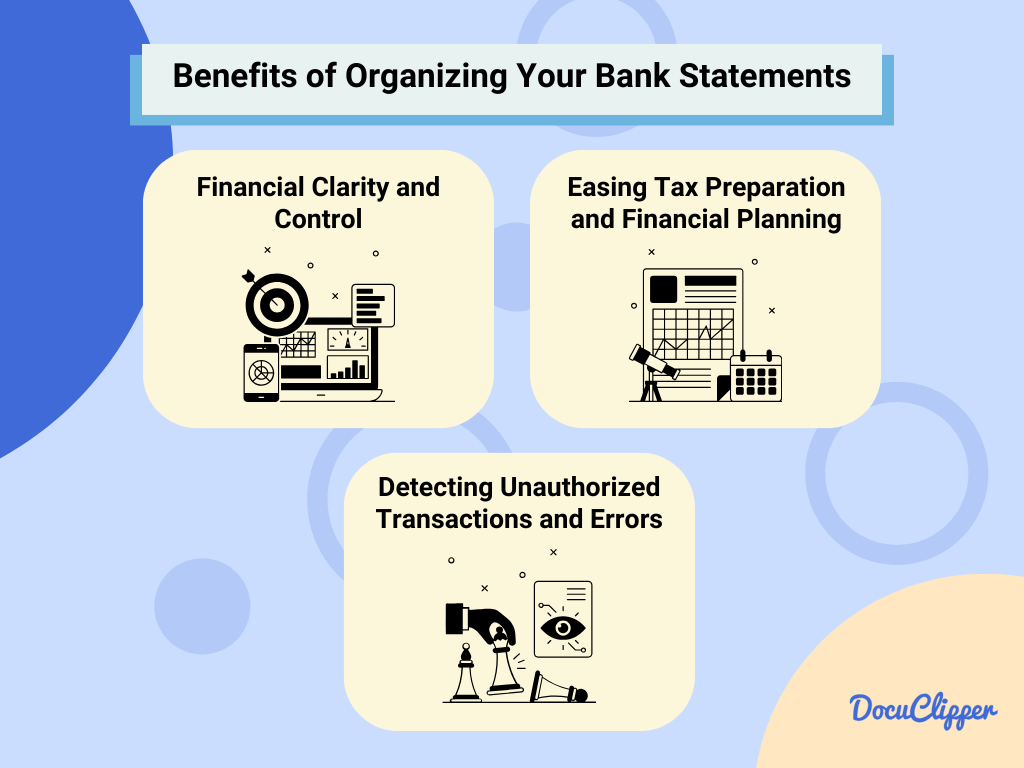

Benefits of Organizing Your Bank Statements

Organizing is beneficial regardless of the industry and context and in finance, putting all the information in order can move things faster and relieve headaches, especially during the tax season. Here are some notable benefits of organizing bank and credit card statements:

Financial Clarity and Control

The center of sound financial management is having a clear and comprehensive view of your financial activities. Organized financial statements are instrumental in achieving this.

- Immediate Access to Financial Data: Organized statements mean you can quickly review your financial status and improve your financial data essential for making informed decisions.

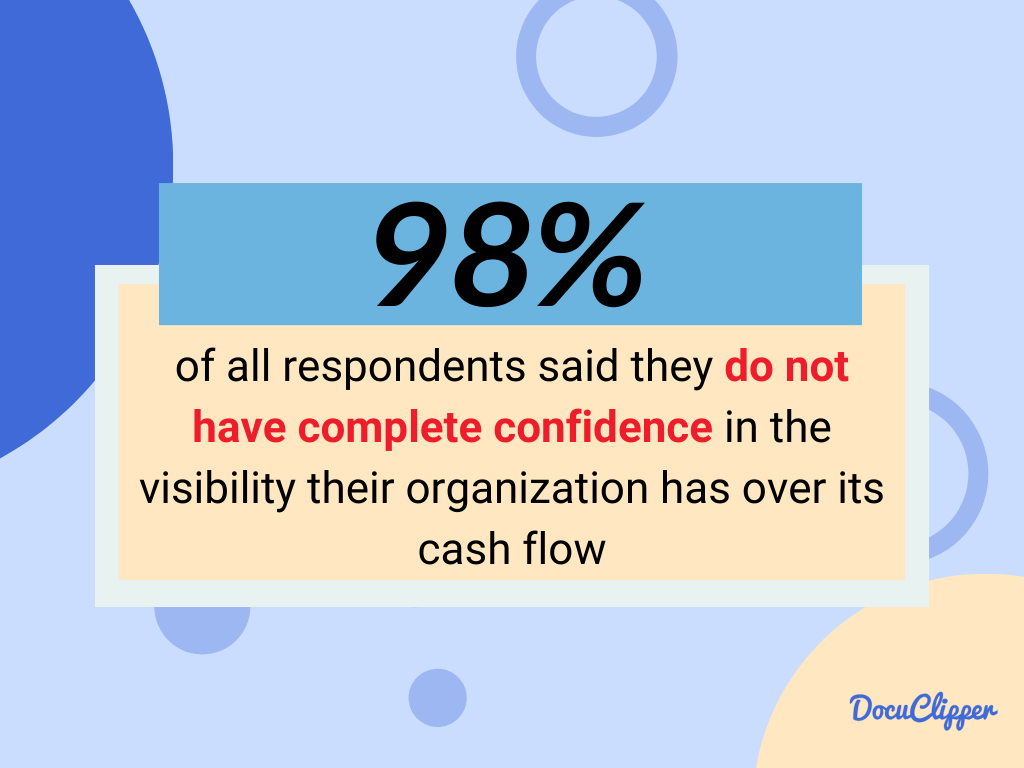

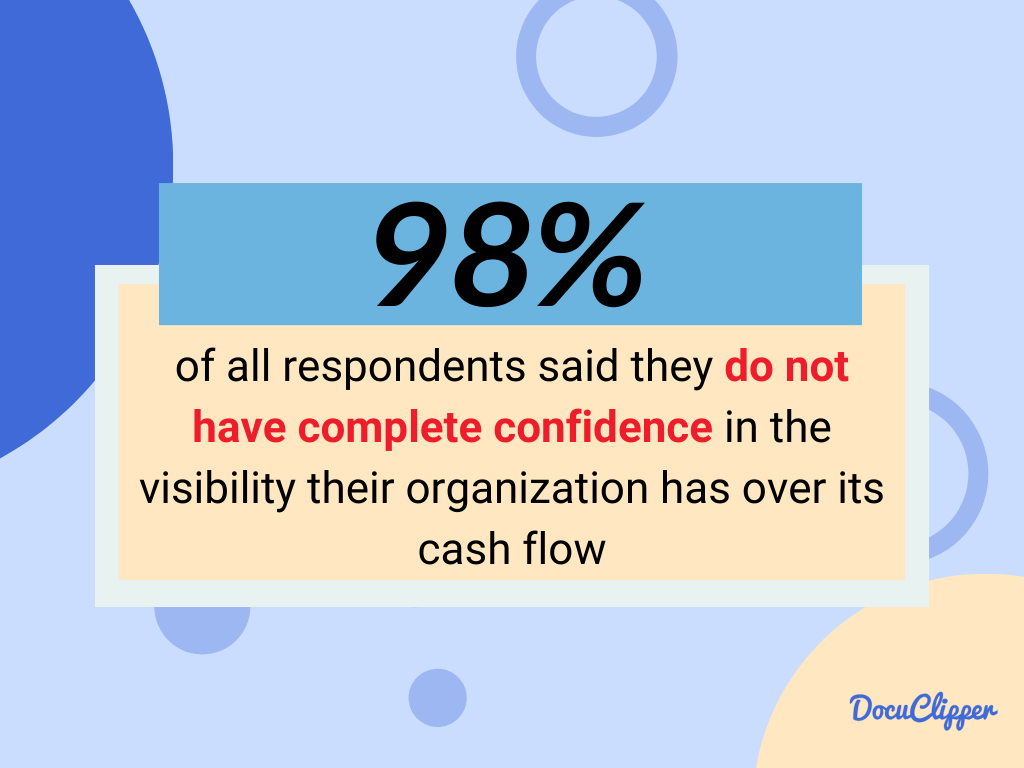

This is especially important as 98% of all respondents said they do not have complete confidence in the visibility their organization has over its cash flow. And 40% of CFOs worldwide do not completely trust the accuracy of their organization’s financial data.

With that, the more accurate financial data you can get, the better decisions you can make leading to improved overall business performance.

- Budgeting and Resource Allocation: With a clear understanding of your financial inflows and outflows from organized records, budgeting becomes more straightforward. It helps in effectively allocating resources and adjusting plans as needed.

Easing Tax Preparation and Financial Planning

Tax preparation and financial planning are integral components of financial management, greatly benefiting from well-organized records.

- Efficiency in Tax Filing: Organized financial records streamline the tax preparation process. The average business owners spend around 24 hours on their taxes or approximately five days (one entire week). But with correctly organized financial documents, this can be cut down and you can focus more on your business instead of the IRS.

- Effective Planning: Organized statements provide a reliable basis for tax planning. They allow business and financial leaders to correctly budget while ensuring that the right amount is set aside for taxes. Because setting aside too much could limit your business growth while setting too little can lead to not having enough money to cover the tax bill.

Detecting Unauthorized Transactions and Errors

The detection of unauthorized transactions and errors is vital for maintaining financial integrity and security. Organized records play a critical role in this aspect.

- Quick Detection of Fraud: An analysis shows a pronounced increase in the incidence of doctored bank statements, escalating from 15% to 29% in September 2020. Fraud is more frequent than it really are Keeping financial statements in order and regularly analyzing them allows for the prompt identification of any unauthorized transactions

- Identifying and Correcting Errors: Despite being very rare, bank statements have an error rate of 0.001%. Yet these errors are detrimental and have costly consequences. Errors in billing, deposits, or withdrawals can occur. Organized financial records make it easier to spot and rectify these errors quickly, ensuring they don’t adversely affect financial health.

How to Organize Bank Statements: A Step-by-Step Guide

Many professionals have different ways of organizing bank and credit card statements, but here is the focus of their organization:

Step 1: Collecting Your Bank Statements

Banks are required to send credit card and bank statements at regular intervals, which can vary based on the type of account you have. These intervals could be monthly, quarterly, or yearly.

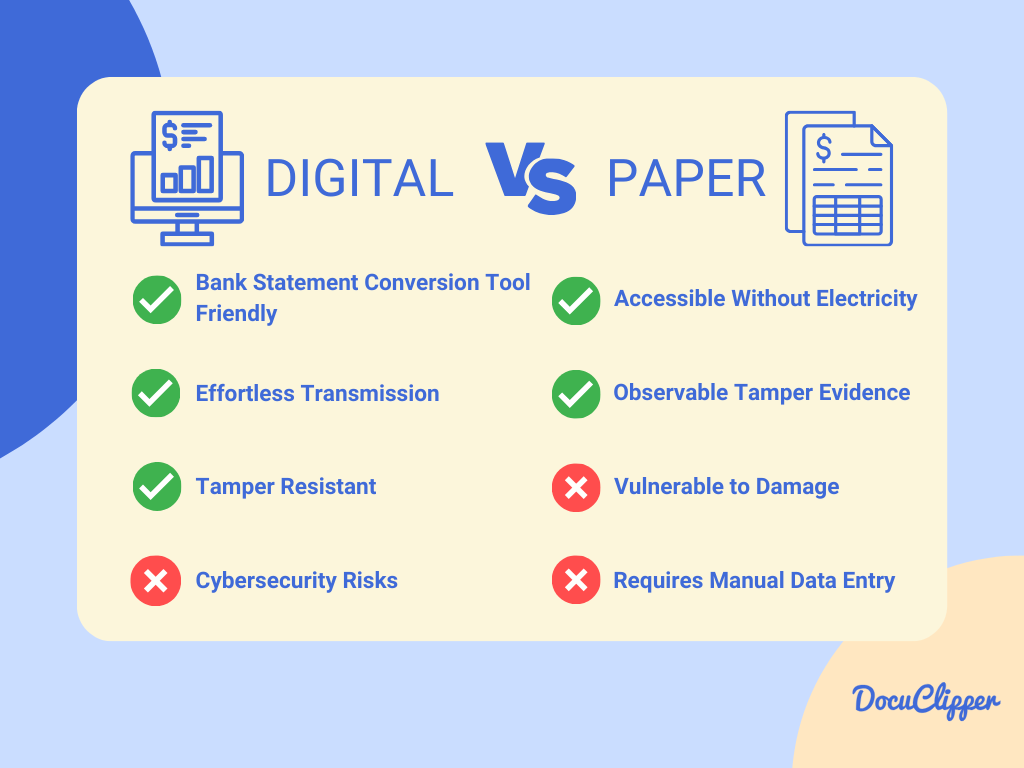

Understanding the frequency and format of these statements is key to organizing them efficiently. Statements are provided in either paper format, which is mailed to you, or as PDFs, which are typically sent via scheduled emails.

Ensure to collect these and not miss any. If you are missing a few for a specific period, you can ask for a statement from your bank. Proper organization of these documents is important for several reasons, including tax preparation and financial audits.

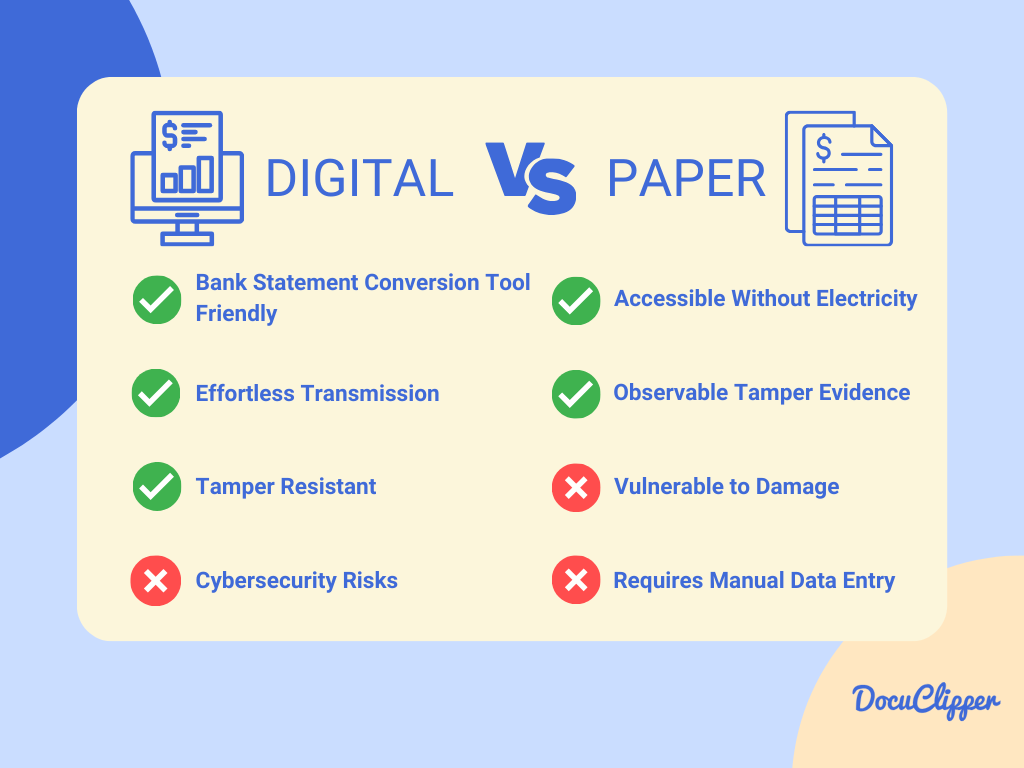

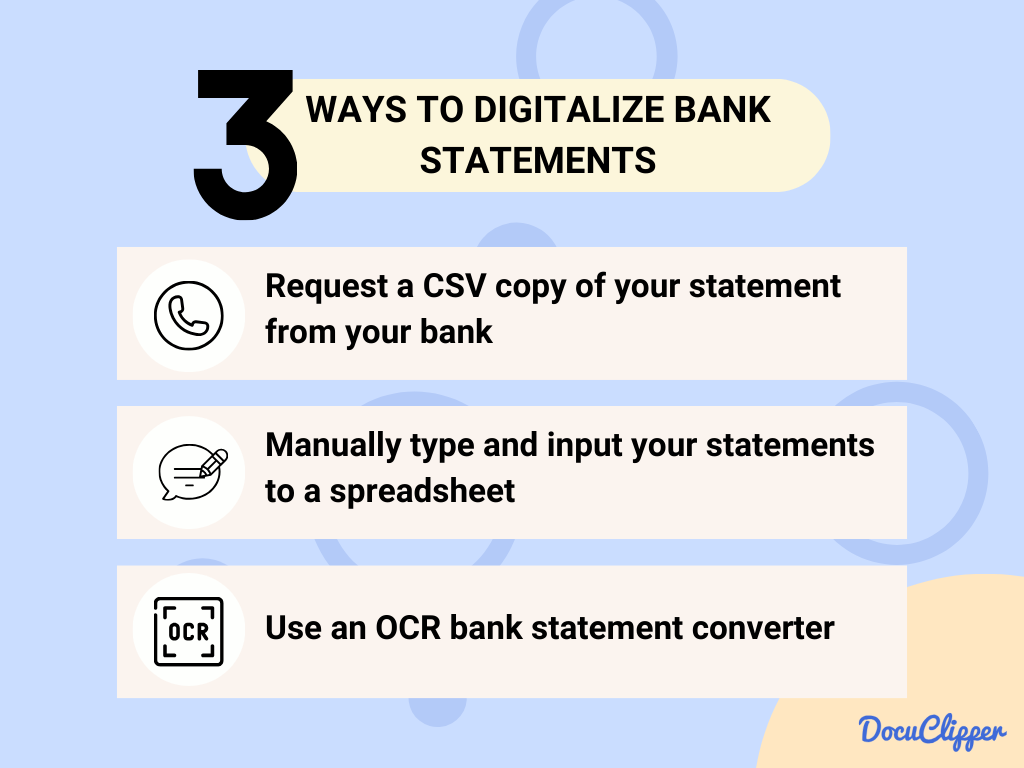

Step 2: Digitalize Your Paper Bank Statements

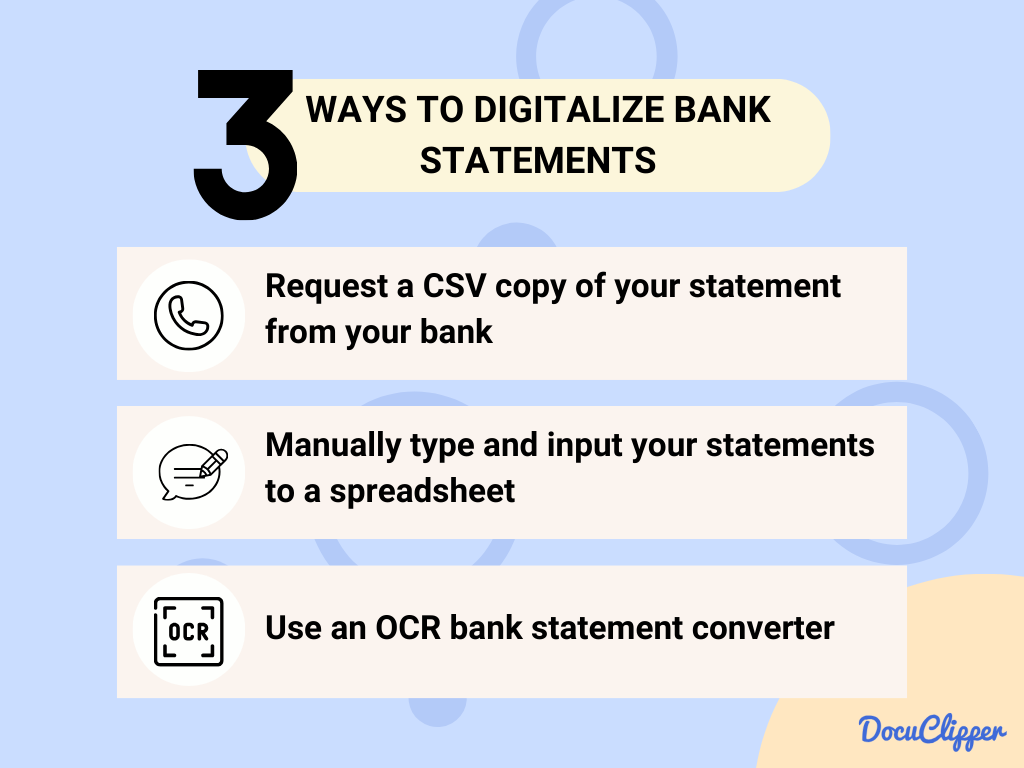

Transitioning your paper bank statements to digital formats enhances the efficiency and accuracy of information processing. This digital transformation enables seamless integration with various banking and accounting systems, facilitating the analysis and transfer of financial data.

- Inquire with your bank about obtaining statements in CSV format. While not all banks may offer this option readily for historical statements, it’s worth asking as it can save time in data processing and integration with accounting software.

- Consider manual data entry as a last resort. Typing information from paper statements into a digital format is time-consuming and error-prone but might be necessary for certain unique or complex transactions that OCR software can’t accurately process.

- Use a scanner to create digital copies of your statements. Scanning provides a versatile method to digitize bank statements, allowing you to save them as PDFs or other digital formats.

It is important to note that bank statements are still useable despite a few years have passed and you should keep your bank statements for at least five years.

Step 3: Categorizing Your Statements

Once your bank and credit card statements are digitized, organizing them becomes a crucial next step. Given the variety in dates, account types, and banks, a systematic approach ensures you can access and analyze your financial data efficiently.

Here’s how finance professionals can put their digitalized statements in order:

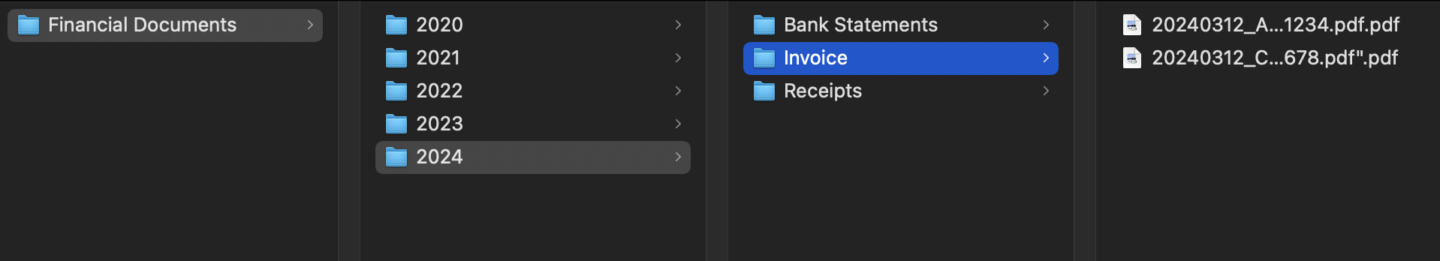

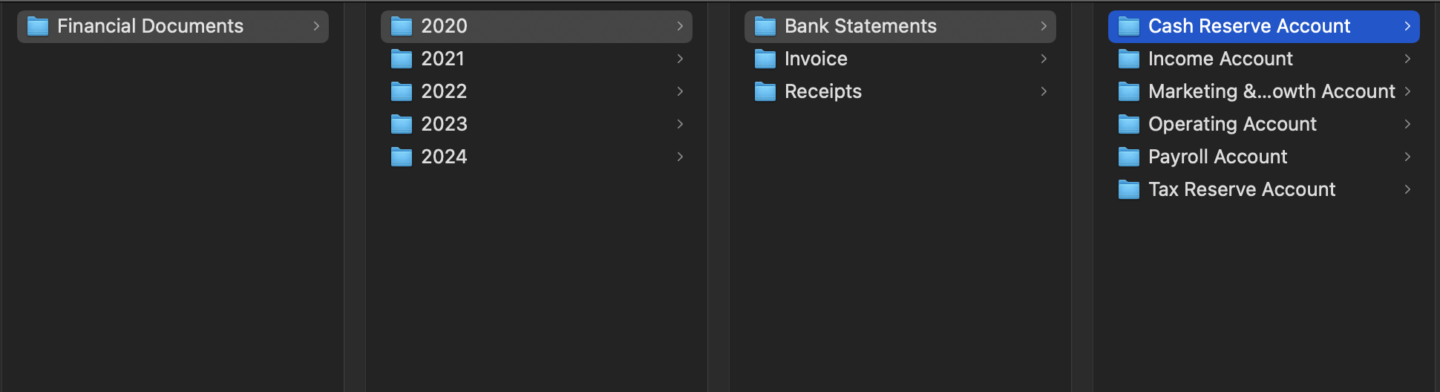

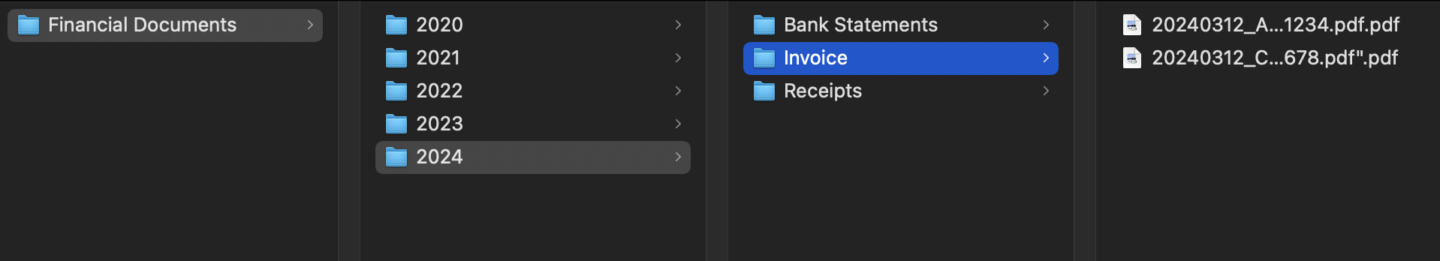

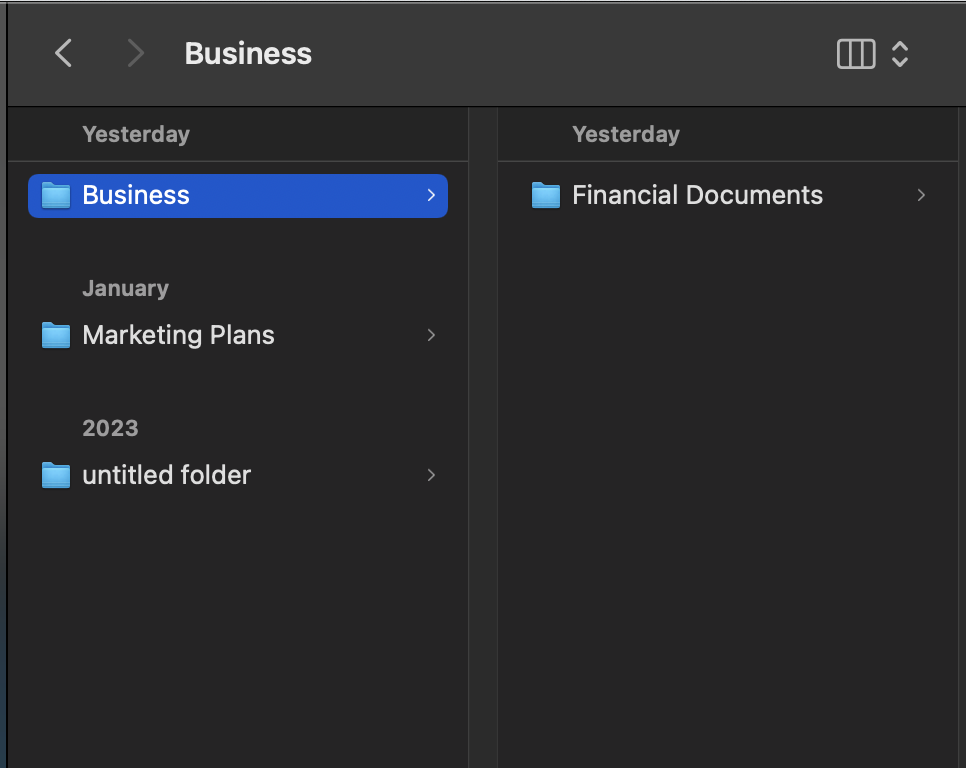

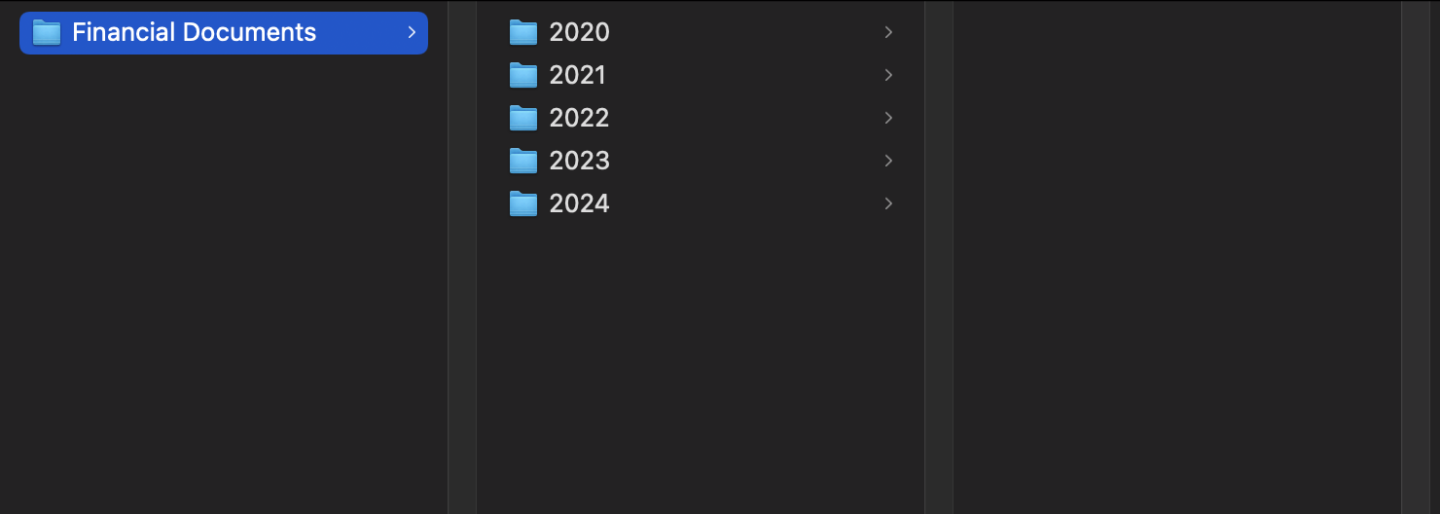

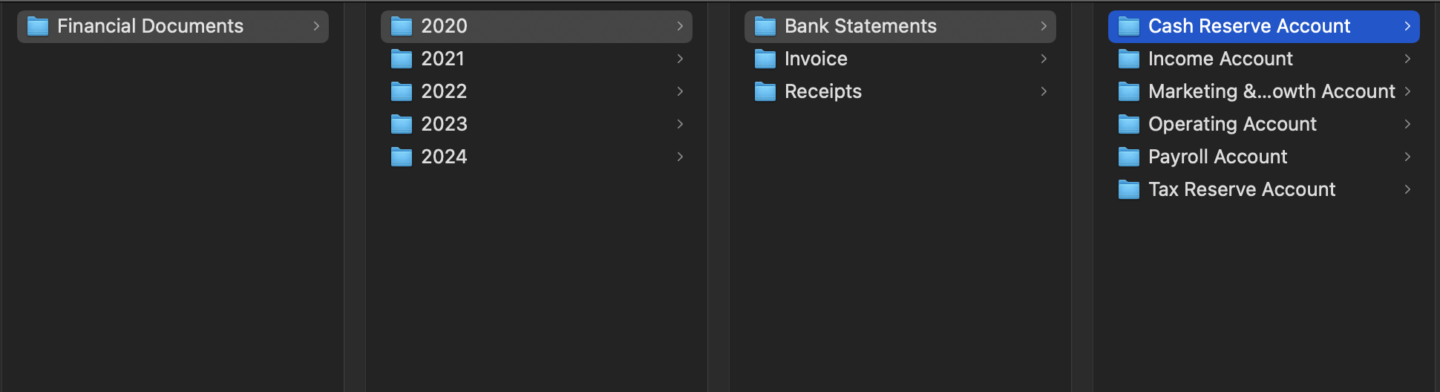

- Create Digital Folders: Similar to the paper-based system, create digital folders on your computer or cloud storage service. This folder you can call something like “Finance” in which you will keep track of all of your financial documents and information.

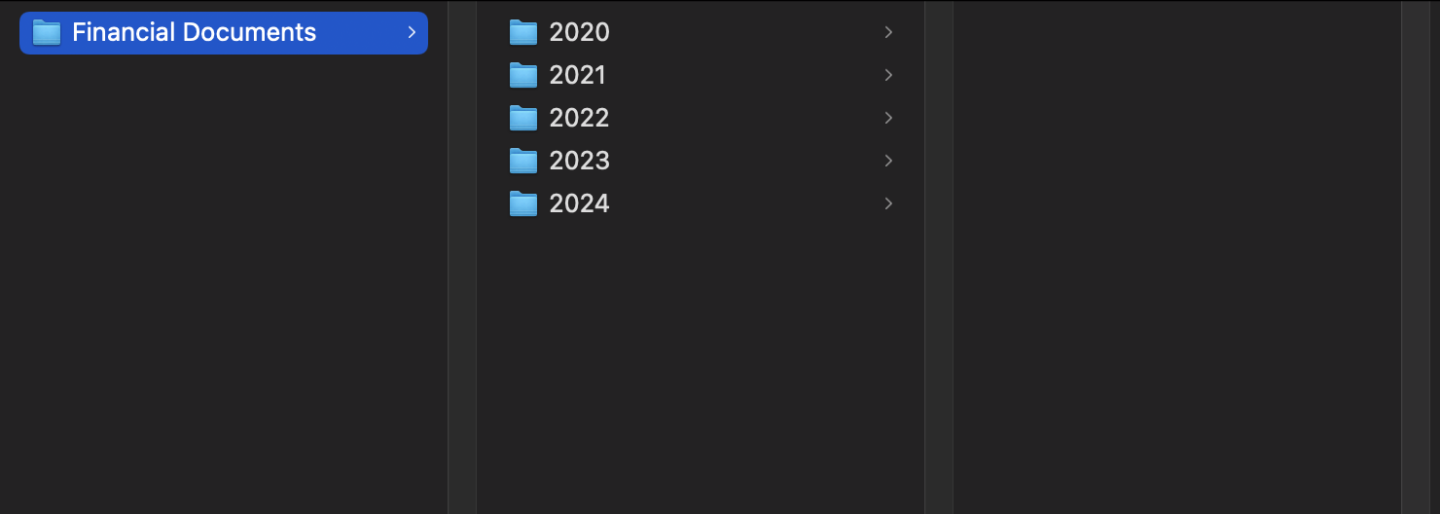

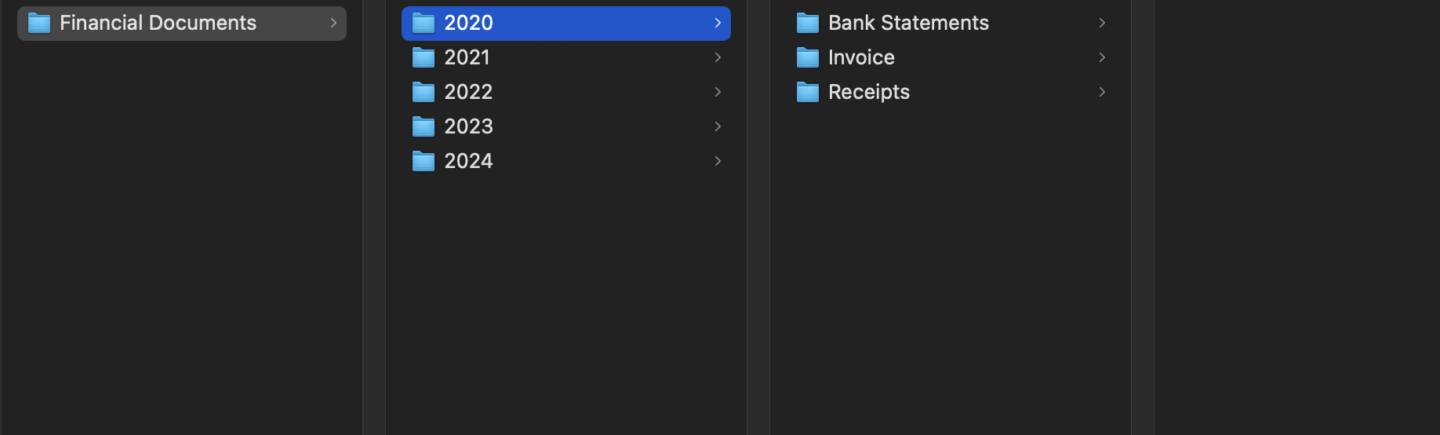

- Sort Bank Statements By Year: Then you should divide your financial documents into years. This will greatly help you with finding the right documents, especially during tax season or even when you get audited by the IRS.

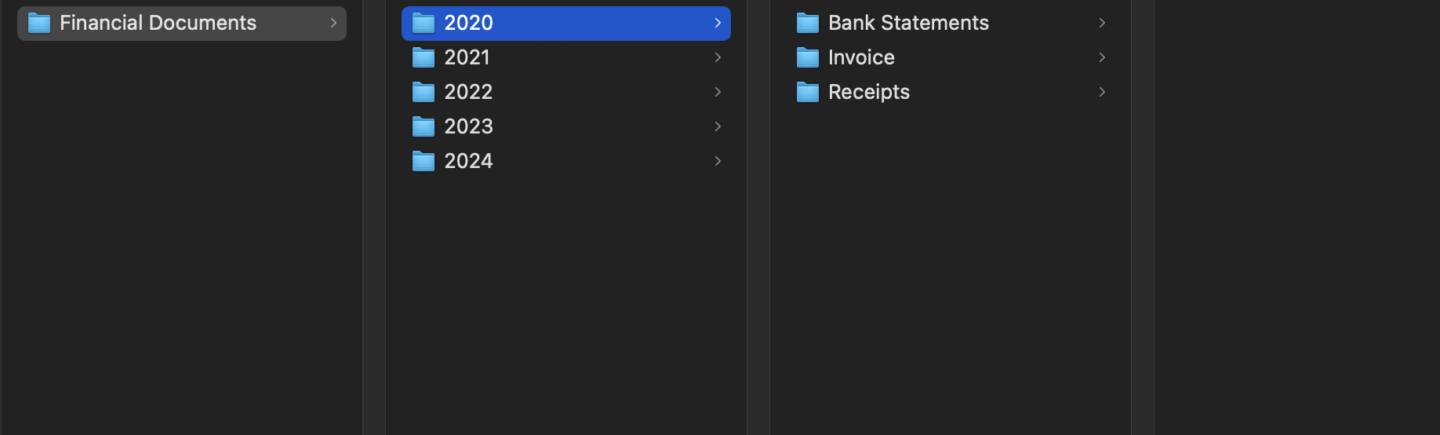

- Create Subfolders by Types: After this, you can create subfolders for different types of financial documents such as bank statements, invoices, and receipts. Like this, you can always find the right financial documents whenever you need them. Learn more about how to organize invoices and receipts.

- Split Bank Statements Into Different Account Folders: Furthermore for bank statements and the year we also recommend you create different folders for your different bank accounts such as for your credit card accounts, Saving Accounts, Tax Accounts, Operational Accounts, Marketing Accounts, etc.

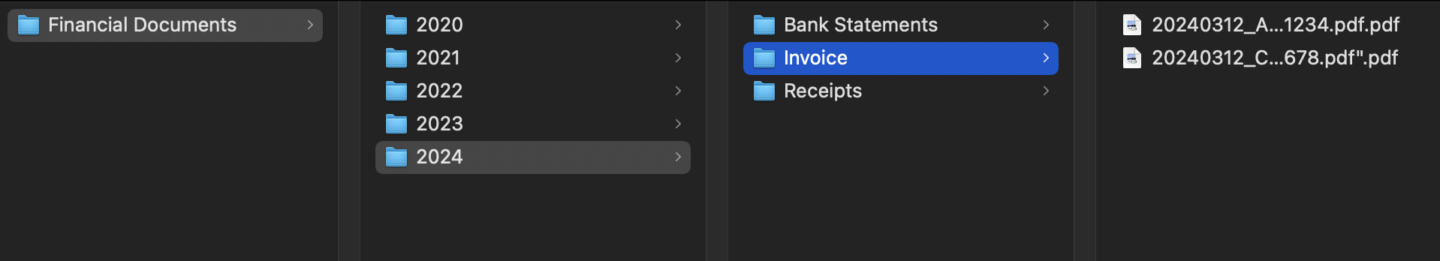

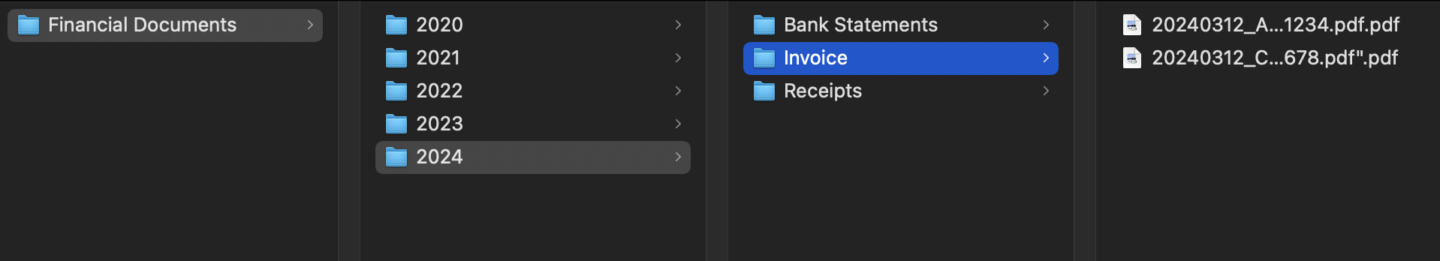

- Naming Conventions: Lastly you want to ensure you name your bank statements, invoices, and receipts in a convenient way. For bank statements, this could be just the name of the bank statement, year, and month as you already sort it out with folders. But for receipts and invoices, you want to name them to be more descriptive so you can quickly tell such as:

- Receipts:”20240312_Amazon_OfficeSupplies_89.99_R1234.pdf” – This tells you the file is a receipt from March 12, 2024, for office supplies from Amazon totaling $89.99, receipt number 1234.

- Invoices:”20240312_ClientXYZ_ConsultingServices_1200_I5678.pdf” – This indicates the file is an invoice from March 12, 2024, for consulting services provided to Client XYZ, totaling $1200, invoice number 5678.

Remember the key in naming is consistency so you know exactly what is what and you can maximize your tax returns.

- Backup: Always have a backup of your digital files, either in a different physical location, like an external hard drive or in the cloud. This protects your documents against data loss due to hardware failure or other issues.

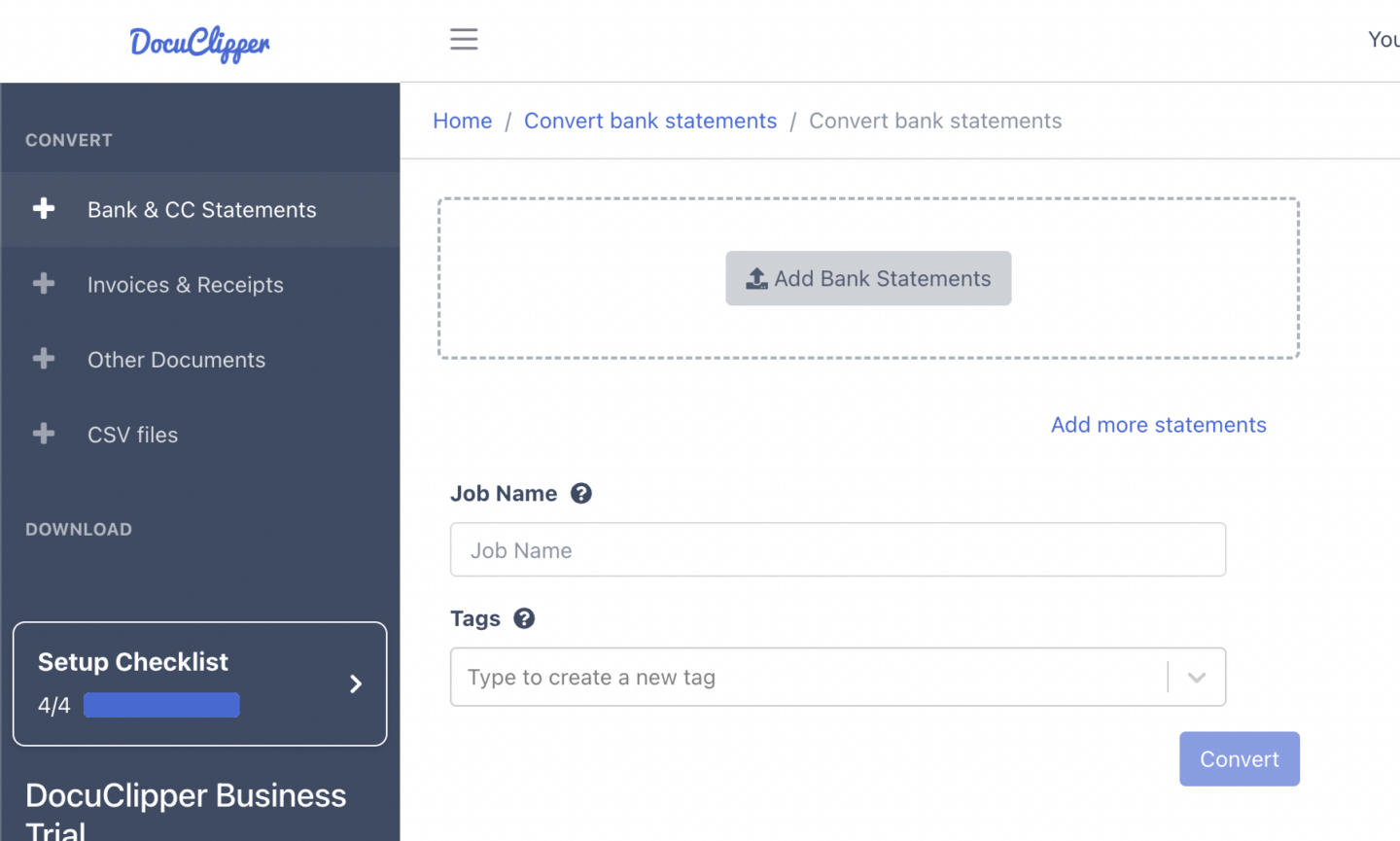

Step 4: Convert Bank Statements to CSV

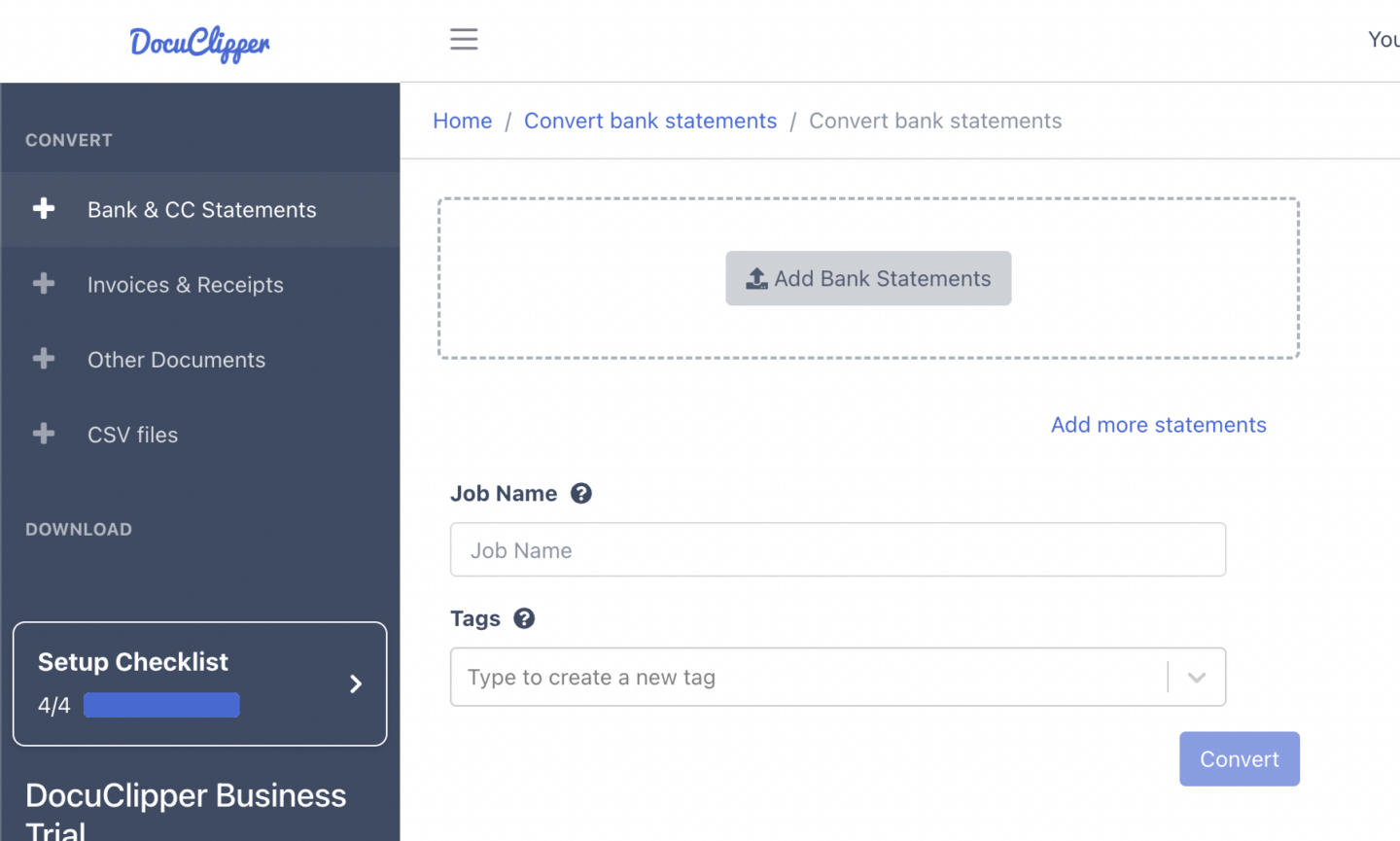

Convert all of your PDF bank statements into CSV as it is much easier to process these documents that way.

Reserving a PDF format and a CSV format will help you during filing taxes. When the tax officer asks you for specific information, you can easily pull it out since it is already organized.

They might also ask for documentation that can supplement your CSV files, so pulling out the PDF statements can help.

- Preserve Original and Convert: It’s crucial to keep an original PDF copy of your bank statements for official records and also have a CSV version for detailed analysis. This dual-format strategy supports both verification and flexible data manipulation needs.

- Select the Right Tools: Opt for conversion tools known for their accuracy and reliability, such as DocuClipper or other OCR (Optical Character Recognition) solutions, which can seamlessly transform PDF statements into CSV format.

- Accuracy Check: After conversion, compare the CSV against the original PDF to confirm all transactions are accurately reflected. Ensure that dates, amounts, and transaction descriptions are consistent across both versions.

Also, learn about:

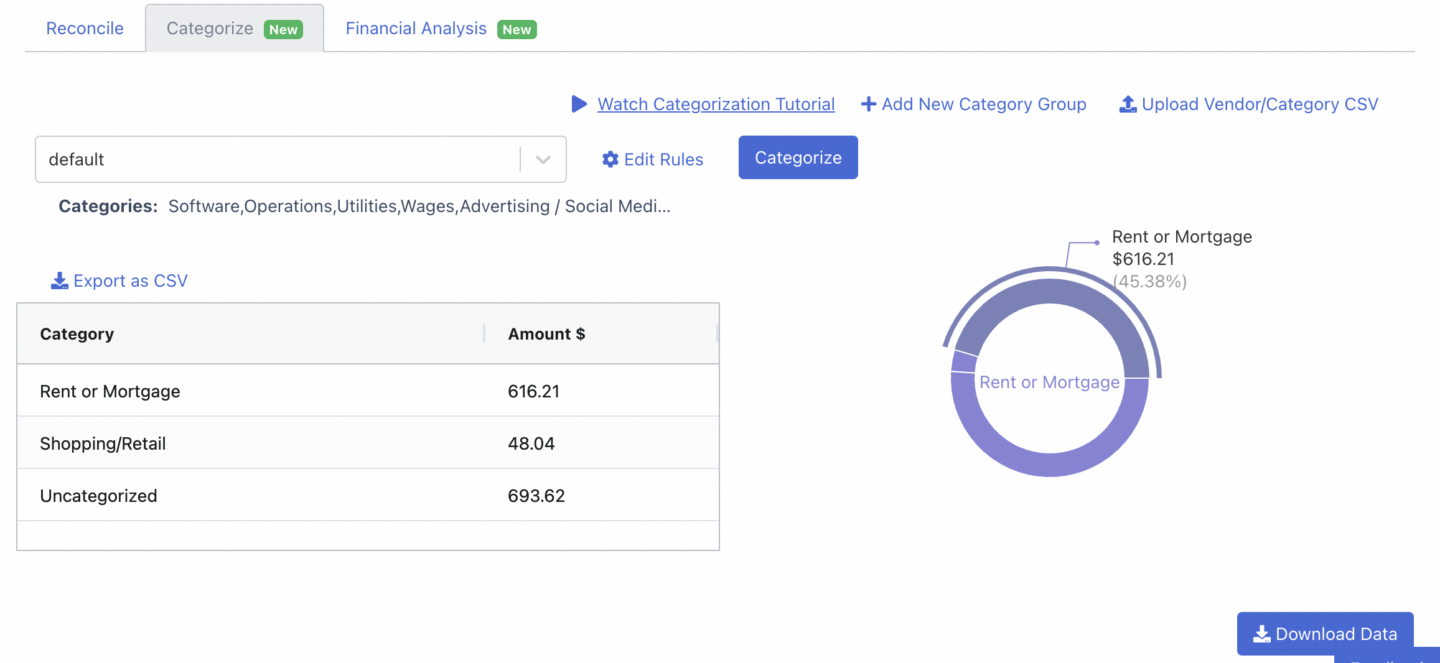

Step 5: Categorize Your Transactions

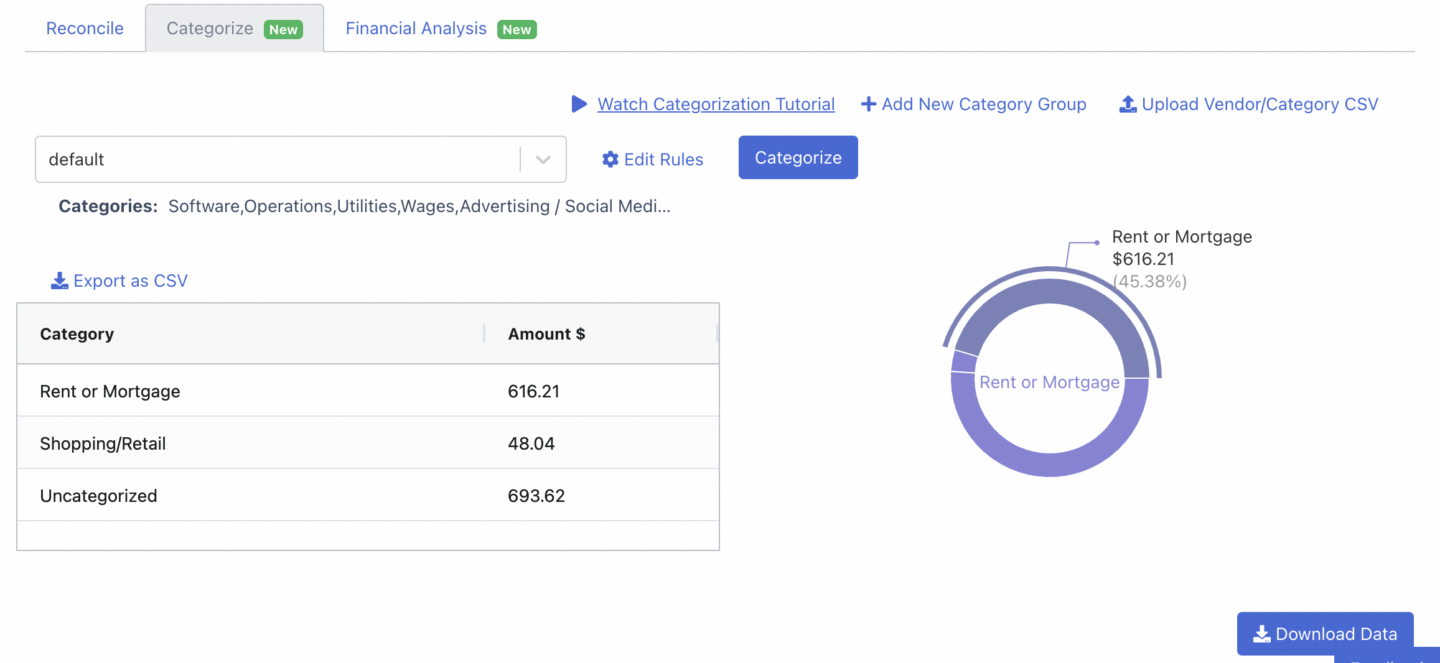

Transaction categorization is an important part of the process of organizing bank statements. It allows you to look at each transaction and their view as categories. This will be helpful when you are tracking losses for business or filing taxes for yourself or for someone else.

Categorizing transactions can be organized according to purpose, vendor or payee, amount, and date in a spreadsheet. You can put the aforementioned classifications as columns to automatically sort them when needed. There are many possibilities, depending on the purpose of your organization.

There are many ways you can categorize bank transactions such as using accounting software, expense tracking software, or spreadsheet, but doing it manually is not an easy task and along with headaches, it does not finish fast. It takes a lot of hours to check every transaction and sort them in a way.

The risk of making mistakes is also huge and mistakes can have detrimental effects on the quality and speed of your work. So the categorization process can be smoother with the help of DocuClipper.

If you are still unsure of how to process, organize, and read bank statements for categorization and reconciliation, you can take a step back before these in-depth processes and read our blog: How to read a bank statement?

Final Advice

Managing and organizing financial statements is a task that looks different for every accountant, bookkeeper, and finance professional, depending on their specific needs and the unique challenges of the businesses they support.

The key to success in this area lies in customizing the approach to match the efficiency goals you have set for your financial management tasks.

Utilizing specialized tools and software can significantly simplify many of these tasks, providing adaptable solutions for a variety of situations.

How DocuClipper Can Help With Your Financial Processes?

DocuClipper is beyond any bank statement converter because of its top-notch features that fit in financial analysis.

Here are the major areas where it can help you during organization:

- Convert PDF Bank Statements Easily: DocuClipper offers a straightforward solution for converting PDF bank statements into formats like CSV, which are more suitable for analysis and reporting. This saves valuable time by eliminating manual data entry and makes financial data more accessible for review and decision-making.

- Automate Transaction Categorization: DocuClipper’s ability to automatically categorize bank transactions is particularly beneficial for detailed financial planning, cash flow analysis, and preparing accurate reports on income and expenses. This feature reduces the time spent on manual categorization and enhances the accuracy of financial records.

- Improve Tax Preparation: DocuClipper can help you access your financial data in PDFs and convert them into spreadsheets, categorize your transactions, analyze cash flow, and income/report, and easily import your bank transactions into your accounting system enabling you to sort your books faster and improve your overall efficiency in tax preparation.

FAQS about How to Organize Bank Statements

Here are some frequently asked questions about organizing bank statements:

What is the best way to store bank statements?

The best method involves digital storage for ease of access and physical storage for original documents in a secure, organized manner, such as in labeled folders in a fireproof cabinet.

How do you organize bank documents?

Organize bank documents by type (e.g., statements, notices), then chronologically within each category. Use clear labels and consider digital copies for easy retrieval.

How do you organize your financial records?

Group your financial records by category (e.g., banking, investments, taxes), and within each, organize documents chronologically. Regularly review and discard outdated documents, adhering to legal retention guidelines.

How do you arrange financial documents?

Arrange financial documents by type and importance, with current documents easily accessible. Use a filing system with categories like taxes, banking, and investments, organized by date.

Do I need to save all my bank statements?

It’s advisable to save bank statements for at least one year for personal review, and longer for tax-related purposes, typically up to seven years, depending on your country’s tax authority guidelines.

How do you filter bank statements?

Filter bank statements digitally using software features that allow you to search by date, transaction type, or amount. For physical copies, organize them in a way that allows you to quickly locate statements by date or account type.

Related Articles:

- Bank Statement vs Bank Certificate: Definition, Differences, Purpose, & Role

- How Long to Keep Bank Statements?

- Bank Statement vs Credit Card Statement: Definitions, Differences, & Roles of Them

- What is Incremental cash flow and how to calculate it

- Guide to OCR for Underwriting