This is the most common word with which we associate present day taxation system. Lesser the cascading effect of taxes, better is the taxation system. In an ideal taxation system, taxes never form part of cost of the product, until the goods or services reach the final consumer.

This is possible only when credit of any taxes paid in the course of business, by the recipient of goods or services is allowed to him. Thus, entire taxes paid by him are set off against his output tax liability and there is no cascading impact of taxes. The taxes attach themselves with the cost only when the goods or services are finally consumed by the consumer.

Input tax credit is nothing but credit of the Input tax. The next question that arises is what is input tax? Here also as the name suggests it is tax on inputs.

The inputs for a business can be divided into three parts:

GST Input Tax Credit provides complete guidance on Input Tax Credit, Refund of Input Tax Credit & Export issues relating to Input Tax Credit. It also incorporates various issues related to Input Tax Credit such as availment, reversal, refund, etc.

Input Services are services which are used or intended to be used in the course or furtherance of business. CGST Act has given a very broad based definition for Input Service. Any service used in the course or furtherance of business, would be classified as Input Service.

The definition of Capital Goods is very broad and contains only two conditions which are as follows:

Input means any goods other than capital goods and which are used or intended to be used in the course or furtherance of business. It is again a very broad based definition and any goods used in the course of furtherance of business, would be classified as Inputs.

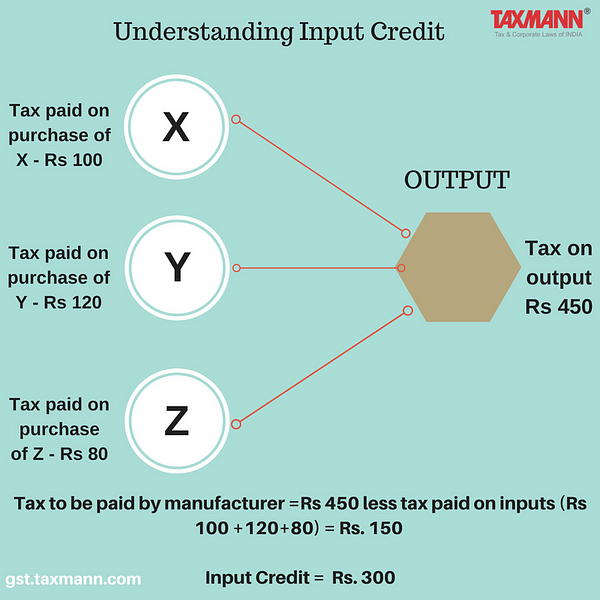

A business uses Input Services, Capital Goods and Input Goods other than Capital Goods for adding value to the goods or services supplied.

Thus, credit of the taxes paid on receipt of Input Services, Capital Goods and Input Goods other than Capital Goods forms the basic foundation upon which the credit structure works.

There needs to be a seamless flow of the Input Tax Credit from one business to another with respect to Input Services, Capital Goods and Input Goods other than Capital Goods, used or intended to be used in the course or furtherance of business.

Related Articles

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

To subscribe to our weekly newsletter please log in/register on Taxmann.com

R.K. Jain's Customs Tariff of India | Set of 2 Volumes

R.K. Jain's Customs Law Manual | 2023-24 | Set of 2 Volumes

R.K. Jain's GST Law Manual | 2023-24

R.K. Jain's GST Tariff of India | 2023-24

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

Author Taxmann Posted on July 11, 2017 November 28, 2023 Categories Blog, GST & Customs Tags GST, Input Tax Credit, Tax Credit

Everything you need on Tax & Corporate Laws. Authentic Databases, Books, Journals, Practice Modules, Exam Platforms, and More.

![]()

Bookstore Support